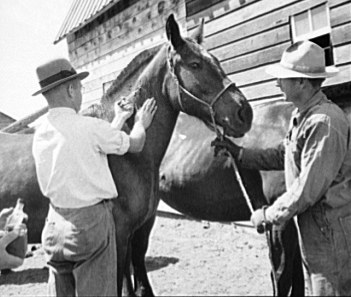

Video with step by step instructions on how to remove a horse shoe in an emergency:

Video with step by step instructions on how to remove a horse shoe in an emergency:

(via The Brooke an international animal welfare organisation committed to improving the lives of working horses, donkeys, mules and their owners.)

Mud and horses go hand in hand but mud is something that we all hate, amongst other things it's unhealthy for our horses harboring bacteria and fungi, creating slippery footing and it makes our horse keeping chores difficult and unpleasant.

Here are a few tips to help minimize mud:

1. A high organic content in soil will create mud so make sure you poo pick at least every two to three days, if you leave that manure in the field it will turn to mud.

2. For the same reason pick up and dispose of any uneaten hay don't leave it in the field.

3. Check rainwater run-off from buidings, ideally you'll have guttering and downpipes directing rainwater into water butts. Make sure the gutters aren't clogged with a build up of dirt and leaves.

4. Avoid over grazing and re-seed bare patches, and keep horses off them until the grass has re-established.

5. Whenever possible keep horses off sodden pasture.

6. Consider removing your horse's shoes during the winter months to reduce the impact hooves make on pasture.

7. Move your watering and feeding areas around to reduce the horse traffic in one area or install firm footing.

8. Install firm footing in high traffic areas such as gateways it will need to be 3" - 6" deep to be effective.

9. Create a "sacrifice" paddock for winter turnout.

10. Limit turnout time.

11. Rotate pastures.

The Equine Influenza vaccination programme consists of a primary course of two injections approx. 4 weeks apart, a booster 6 months later followed by an annual booster injection.

There are strict rules for competition horses:

The 1st and 2nd injections should be no less than 21 days apart and no more than 92 days apart.

The 2nd and 3rd injections should be no less than 150 days apart and no more than 215 days apart.

The horse should receive its' annual booster on or before the anniversary of the previous injection.

Please note:

FEI rules require a 6 monthly booster.

Racehorses must have 6 clear days after vaccination before entering a racecourse stable and must have at least the primary course of 2 injections to be eligible to enter a racecourse.

Image via Wikimedia Commons

Although burdock root is a popular component in herbal remedies for horses being an excellent blood purifier and an excellent healing herb for skin conditions you don't really want burdock in your paddocks.

Whilst not technically poisonous to horses if the burrs are ingested they can cause damage to the upper gastrointestinal tract, irritation of the mouth, tongue and teeth and oral ulcers. Symptoms include excessive salivation, drooling or frothy saliva.

In addition to the annoyance of burdock burs tangled in manes and tails the burs can actually cause cause ocular lesions and "seed" the eyes if caught in the forelock.

Burdock is a biennial weed that can be treated by spot treatment of a weedkiller, the best time to do this is June or July.

Zoonotic diseases are diseases that can be passed from animals to humans. Although the average horse owner is unlikely to contract a disease or infection from their horse it's a good idea to be aware of the diseases that could infect you so that you can take the necessary precautions should you be unfortunate enough to come into contact with them.

The following list includes diseases that can be caught by direct transmission from equine to human via

and by indirect transmission ie. via an insect vector (eg. insect bite ) and by contact with an inanimate object (eg. through contact with contaminated equipment).

Piroplasmosis can affect horses, dogs, cows and humans it is a tick borne disease caused by two single-celled (protozoal) organisms, Theileria equi (T. equi) and Babesia caballi (B. caballi).

Piroplasmosis can affect horses, dogs, cows and humans it is a tick borne disease caused by two single-celled (protozoal) organisms, Theileria equi (T. equi) and Babesia caballi (B. caballi).

Most prevalent during August to October Equine Piroplasmosis is a potentially life threatening illness. Currently the UK is considered free of the disease but it is endemic in many countries, the tick population is increasing in the South East of England and imported equines from Europe and other countries that may be carriers of the disease do make the UK vunerable.

Because Equine Piroplasmosis is rare in the UK we may not be familiar with the symptoms and valuable time may be lost in beginning treatment, diagnosis is made via blood tests.

Once an infected tick has bitten the horse, it can take 7 to 22 days for

the babesia to incubate.

Urgent veterinary treatment is required, Equine Piroplasmosis affects the heart, liver and kidneys and because of similarity of the clinical signs it can be confused with laminitis, colic or azoturia so ask for blood tests.

Treatment is with anti-protozoan drugs combined with supportive drugs for any affected organs, a blood transfusion is necessary.

Sometimes horse appear to have recovered after treatment to have the symptoms re-appear after 7 – 10 days.

The following information on nursing has been gathered by Equine Rescue France to help owners:

Image of tick: Aka via Wikipedia Commons licensed under the Creative Commons Attribution-Share Alike 2.5 Generic

Tabanidae flies are the largest of blood sucking flies, there are approximately 4,500 species found world wide, 30 of which can be found in the UK. Adult flies feed on nectar but as a haematophagous fly the female horsefly feeds on blood to obtain the necessary nutrients for the development of their eggs and they will attack a wide variety of animals including horses and their human handlers.

The horsefly (genus Tabanus) bite is very painful as the female horsefly cuts and rasps the skin with powerful mandibles and maxillae to create a feeding hole. The blood is sucked using a protruding hypopharynx which causes pain to the host.

Tabanids can take up to 300ml of blood a day from a host severely weakening the animal, they are also known vectors for blood- borne diseases such as Equine Infectious Anaemia. Horse fly bites are nasty resulting in lumps with a characteristic central ulcer. They can become infected.

Horsefly larvae inhabit moist areas feeding on invertebrates like snails and worms before they pupate. The adult horsefly emerges in June and July, the greatest

horsefly activity occurs on warm, sunny days when there

is little or no wind.

Insecticides containing pyrethroids (Permethrin or Cypermethrin) offer horses some protection against horse flies. Also consider stabling your horse on warm, sultry days when horse flies are active, horse flies don't like dark areas and will not go into the stable.

To avoid being bitten yourself, wear long sleeved tops, apply a repellent that contains diethyltoluamide (DEET) and wear light coloured clothing which apparently doesn't attract the flies like darker colours.

Image: Dennis Ray

Did you know that buttercups are poisonous?

All parts of the ranunculus species (buttercups, crowfoot, spearwort, marsh marigold) contain the glycoside ranunculin which forms protoanemonin an irritant substance. All domestic animals, including horses, are suscepitible to protoanemonin poisoning.

Buttercups do have a bitter burning taste which acts as a deterrant to horses eating them but when there are large quantities of buttercups in pasture it can become impossible for the horse to avoid them. The highest concentration of protoanemonin is present during flowering.

Symptoms of buttercup poisoning include:

Excess Salivation

Mouth ulcers and difficulty eating

Swelling of the face

Skin blistering

Colic

Diarrhoea

Discoloured urine

Inco-ordination

Staggering

Impaired hearing and sight

Convulsions

Although extremely rare, due to the symptoms stopping the horse or pony from eating, buttercup poisoning can result in death.

Buttercups in hay

Buttercups are non-toxic when dried so you don't need to worry if you find them in hay or haylage.

Removal of buttercups

Buttercups are obviously undesirable in your horses pasture and being an extremely invasive plant they need to be removed. Buttercups thrive in poor compacted soil, aerating and draining the soil will help reduce numbers. Harrowing breaks the runners and reduces numbers. They can be killed by the use of a suitable weed killer but you should note that buttercups appear to be more palatable to animals after the use of weed killers and there is a greater risk of poisoning. Treated pastures should not be grazed for at least 2 weeks after the use of herbicides.

Alder Buckthorn (Frangula alnus)

Annual Mercury (Mercurialis annua)

Arum Lily (Zantedeschia species)

Autumn Crocus (Colchicum autumnale)

Azalea (Rhododendron species)

Beech (Fagus sylvatica)

Birthwort (Aristolochia species)

Black Bryony (Tamus communis)

Bluebell (Hyacinthoides non-scripta)

Box (Buxus sempervirens)

Bracken (Pteridum aquilinum)

Buckthorn (Rhamnus carthartica)

Buttercup (Ranunculus species)

Cannabis (Cannabis sativa)

Castor Oil Plant (Ricinus communis)

Cheese Plant (Monstera deliciosa)

Cherry Laurel (Prunus laurocerasus)

Chickweed ( Stellaria species)

Columbine (Aquilegia species)

Corn Cockle (Agrostemma githago)

Cowbane (Cicuta virosa)

Crow Garlic (Allium vineale)

Cuckoo Pint (Arum maculatum)

Cypress (Cupressus species)

Daffodil (Narcissis species)

Deadly Nightshade (Atropa belladonna)

Delphinium, Larkspur (Delphinium species)

Dodder (Cuscuta species)

Dog's Mercury (Mercurialis perennis)

False Hellebore (Veratrum species)Fat Hen ( Chenopodium album)

Flamingo Flower (Anthurium species)

Foxglove (Digitalis purpurea)

Giant Hogweed (Heracleum mantegazzianum)

Greater Celandine (Chelidonium majus)

Ground Ivy (Glechoma hederacea)

Hydrangea (Hydrangea species)

Hemlock (Conium maculatum)

Hemlock Water Dropwort ( Oenanthe crocata)

Hemp Nettle (Galeopsis species)

Henbane (Hyoscyamus niger)

Holly (Ilex aquifolium)

Horse Chesnut ( Aesculus hippocastanum)

Horse Radish (Armoracia rusticana)

Horsetail (Equisetum species)

Iris (Iris species)

Ivy (Hedera helix)

Jonquil (Narcissus species)

Laburnum (Laburnum anagyroides)

Laurel (Prunus laurocerasus)

Lily of the Vally (Convallaria majalis)

Lupin (Lupinus species)?

Marsh Marigold (Caltha palustris)

Mezereon (Daphne mezereum)

Milk Vetch / Loco Weed (Astragalus species)

Mistletoe (Viscum album)

Monkshood (Aconitum napellus)

Morning Glory (Ipomoea species)

Narcissus (Narcissus species)

Oak (Quercus species)

Oleander (Nerium oleander)

Onion (Allium cepa)

Opium Poppy (Papaver somniferum)

Perforate St. John's Wort (Hypericum perforatum)

Petty Spurge (Euphorbia peplus)

Pieris (Pieris species)

Pokeweed (Phytolacca americana)

Poppy (Papaver species)

Potato (Solanum tuberosum)

Privet (Ligustrum species)

Purple Viper's Bugloss (Echium plantagineum)

Ragwort (Senecia jacobaea)

Ramsons (Allium ursinum)

Red Maple (Acer rubrum)

Rhododendron (Rhodendron ponticum)

Rhubarb (Rheum rhaponticum)

St. Baranaby's Thistle (Centaurea solstitialis)

St. John's Wort (Hypericum species)

Sandwort (Arenaria species)

Soapwort (Saponaria species)

Solomon's Seal (Polygonatum multiflorum)

Sorrel (Rumex acetosa)

Spindle (Euonymus europaeus)

Spurge Laurel (Daphne laureola)

Sun Spurge (Euphorbia helioscopia)

Thorn Apple (Datura straemonium)

Traveller's Joy (Clematis vitalba)

White Bryony (Bryonia dioica)

Wisteria (Wisteria species)

Wood Anemone (Anemone nemorosa)

Wood Sorrel (Oxalis acetosella)

Woody Nightshade (Solanum dulcamara)

Yellow Flag (Iris pseudacorus)

Yellow Star Thistle (Centaurea solstitialis)

Yew (Taxus baccata)